Here’s a summary of a market analysis on a multi-family apartment building for sale in Tokyo. Transport-wise, it’s an area that offers a short commute for office workers.

Digging into the data

Between the target building and train station, there were 29 apartment buildings with a total of 4,800 units. That’s an average of 168 units per building.

- 9 of those 29 buildings were built within the past 15 years.

- 40% of the apartment stock is in buildings over 30 years old.

With all those apartments, there must be a lot of vacant ones, right?

Wrong. The vacancy rate was just 0.5%. Half of the buildings had no apartments advertised for rent. This seems to indicate some tight rental conditions.

Rental pricing

Rental pricing

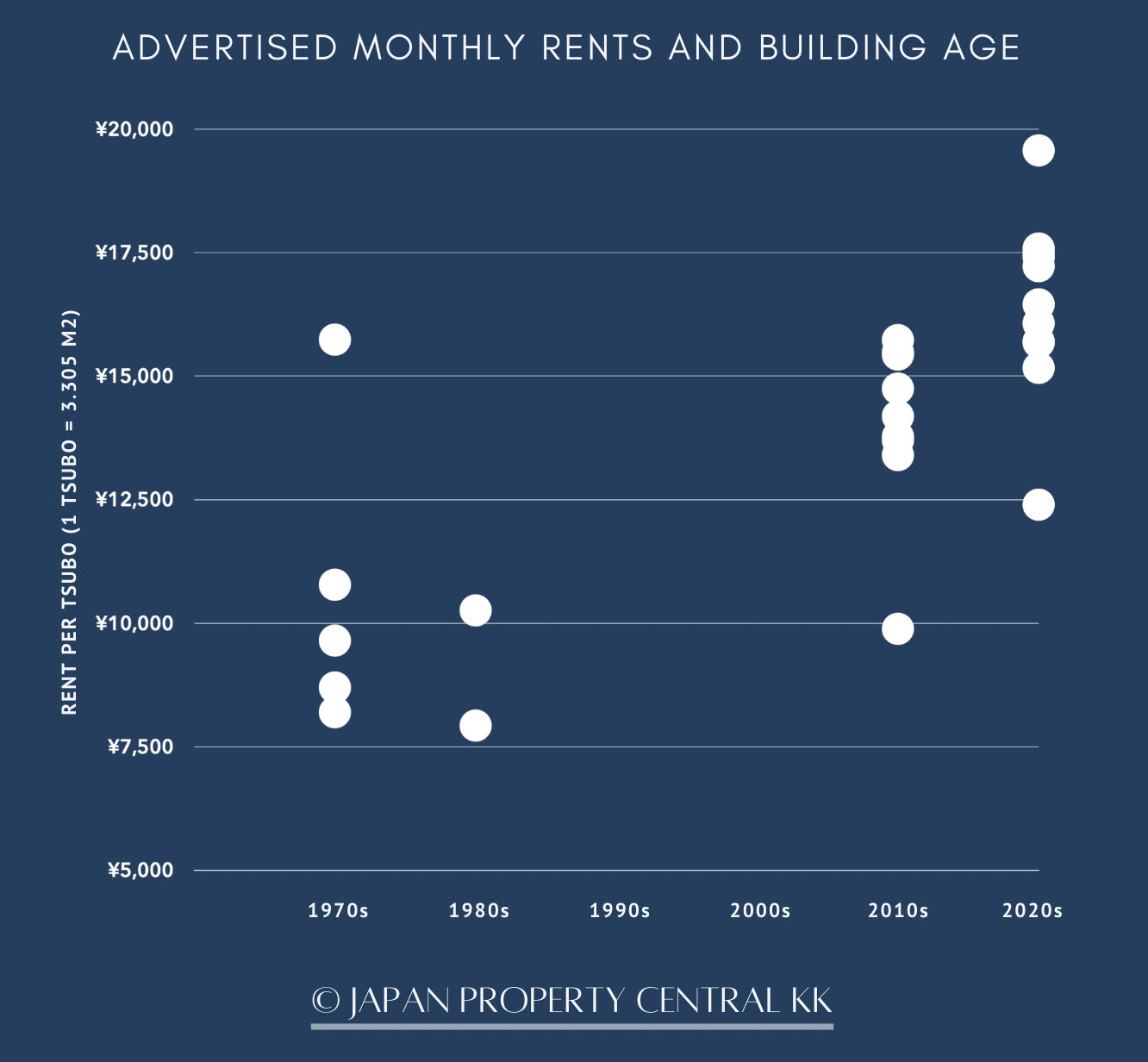

The average monthly rent for buildings built within the past 15 years was 15,800 Yen per tsubo (approx. 4,780 Yen/m2). For buildings over 30 years old, it was 10,000 Yen/tsubo (3,025 Yen/m2), or about 37% cheaper.

Over the past 10 years, average rents in three sample buildings have increased by between 15 ~ 30%.

Demographics

The household size in this neighborhood is 2.03 persons as of January 2024, down from an average household size of 2.13 persons in 2014. 42% of the residents are under the age of 40 and 20% are aged 65 and above. Overall, the population has grown by 15.8% over the past 10 years.

![]()

+ There are no comments

Add yours