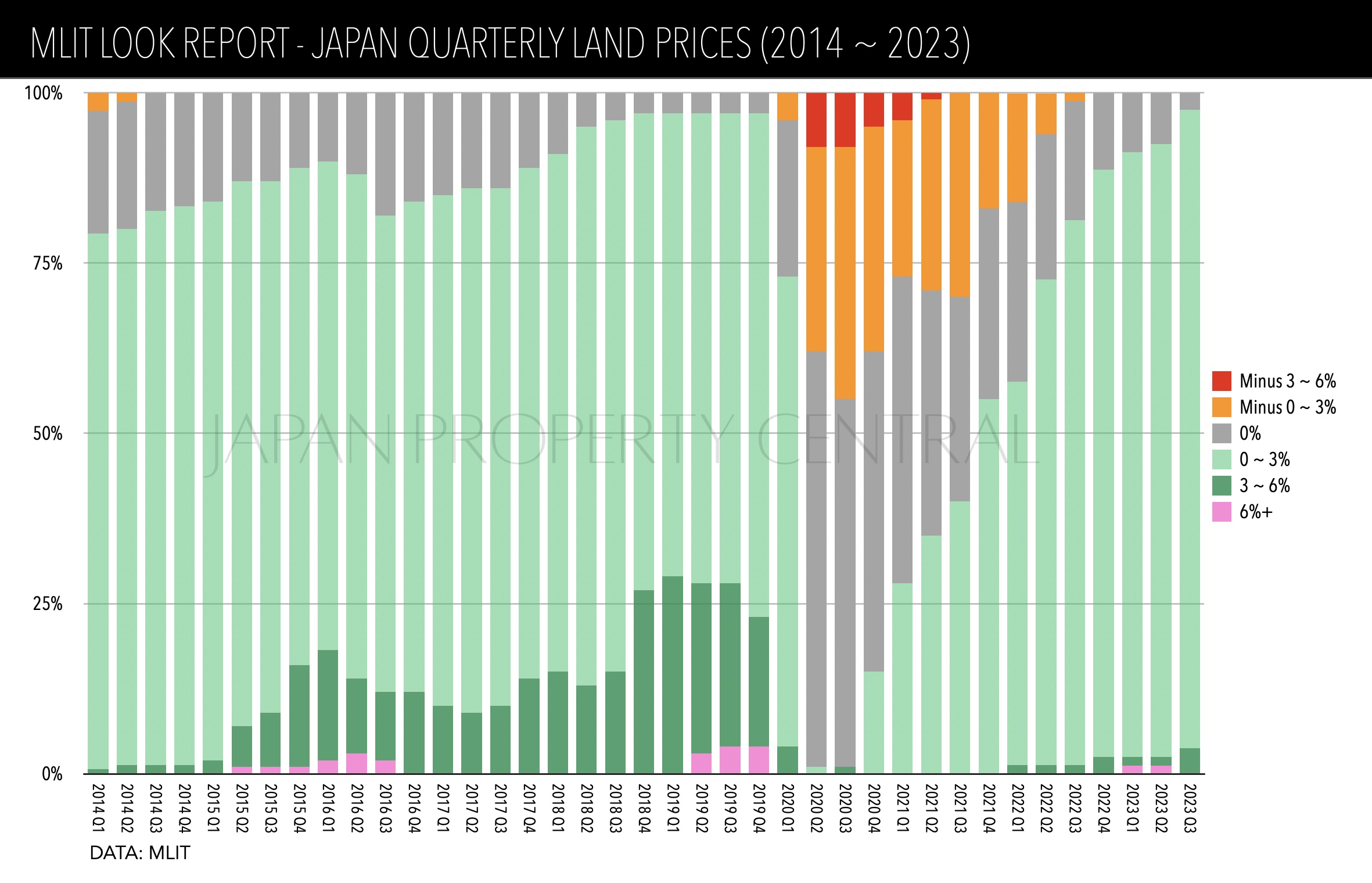

Land values across Japan are rising at an increasing pace after suffering some declines during the pandemic. The rising prices are due to improving economic conditions, strong demand for apartments, and signs of a recovery in retail demand. According to the latest quarterly LOOK report published by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), 97.5% of the surveyed locations saw positive growth in the 3rd quarter of 2023 – the highest share seen on record. No locations saw a drop in prices.

For residential land, all surveyed sites saw positive growth. For commercial, 90% saw growth and 10% saw no change.

Tokyo’s Marunouchi district, the heart of the city’s high-rise office district, switched from no growth in the 2nd quarter to 0~3% growth in the 3rd quarter. Nearby Yurakucho and Hibiya also saw a similar shift. Ginza went from 0~3% in the previous quarter to 3~6% growth in the latest quarter.

Roppongi ended a four-quarter streak of zero growth, switching over to 0~3% growth. Several large-scale office projects have seen positive leasing activity with rents remaining stable. The return of office workers and tourists has led to an increase in inquiries from potential retail tenants looking to capitalize on the rising level of foot traffic. Investors are also taking advantage of low interest rates and actively making aquisitions of existing buildings and development sites.

Only two locations in Tokyo saw no growth – Tachikawa to the west, and the Daiba/Aomi manmade island on Tokyo Bay. Tachikawa is the main office district for the Tama district in western Tokyo and has retained stable office investment and leasing conditions. Daiba/Aomi’s retail sector has suffered throughout the pandemic due to the drop in tourists and lack of passenger ships, with vacancies becoming apparent for some food and beverage and retail spaces, although hotel demand has recovered. Future large-scale redevelopments are planned for this district and demand may recover in the future.

The Kyoto Station area saw a 3~6% increase in land values. This is the 3rd quarter to see this level of growth. This is a high density area for office and retail. Although there has been some difficulty attracting tenants to older office buildings, the lack of new construction and the prime location means that rents are expected to remain stable. Hotels have also benefitted from high occupancy rates due to the rapid return of foreign tourists post-pandemic. Retail demand also remains high.

Source: MLIT, November 17, 2023.

![]()

+ There are no comments

Add yours